CQE $2.52 AUD

0.59%

30 April 10:36 AEDT, delayed by 20 mins.

Charter Hall Social Infrastructure REIT (ASX:CQE)

Explore our Properties

Charter Hall Social Infrastructure REIT (ASX:CQE) is the largest Australian ASX listed real estate investment trust (A-REIT) that invests in social infrastructure properties.

.jpg?sfvrsn=d5058cc6_4)

360

Operating properties

32.5

Gearing

12.8 years

Weight Average Lease Expiry

$2.2 billion

Total Property Assets

*As at 31 December 2023

Property Portfolio Statistics

As at 31 December 2023

| No. | Value ($M) | % of Total Property Assets | Passing Yield (%) |

QLD | 118 | 55.9 | 25.1 | 4.8 |

VIC | 82 | 497.5 | 22.5 | 4.9 |

NSW / ACT | 80 | 314.3 | 14.2 | 5.3 |

WA | 42 | 225.0 | 10.2 | 4.9 |

SA | 26 | 99.4 | 4.5 | 5.1 |

TAS / NT | 4 | 14.3 | 0.6 | 4.8 |

Total - Childcare1 | 352 | 1,705.7 | 77.1 | 5.0 |

Mater Headquarters & Training Facilities | 1 | 124.0 | 5.6 | 5.1 |

Geoscience Australia | 1 | 88.3 | 4.0 | 7.8 |

SA Emergency Command Centre | 1 | 82.5 | 3.7 | 4.4 |

iQ Westmead | 1 | 64.4 | 2.9 | 5.0 |

Brisbane Bus Terminal2 | 1 | 59.0 | 2.7 | 5.0 |

Robina (TAFE & Wise Medical) | 2 | 37.3 | 1.3 | 4.4 |

Healius - Diagnostics | 1 | 30.0 | 1.4 | 5.0 |

Developments3 | 3 | 20.2 | 1.0 | - |

Total Portfolio | 363 | 2,211.8 | 100.0 | 5.14,5 |

1. Includes 30 leasehold properties with a value of $23.3 million with passing yield of 19.1%

2. Equity value of CQE 50% interest in Brisbane Bus Terminal is $33.9 million, net of asset level debt of $26.1 million and other net assets of $1.0 million

3. Development properties include Doncaster and Templestowe Lower which are due for completion and lease commencement in 2H FY24 with remaining cost to complete of $1.2 million. The development site at Reservoir is no longer proceeding and will be divested.

4. Passing Yield excluding Developments

5. Passing Yield is 4.9% after deducting non-recoverable, multiple holding land tax of $2.6 million paid at Fund level

Lease Structure

- Triple net leases – all costs including outgoings, except Qld land tax, payable by the tenant.

- Rent, structural repairs, general repairs and maintenance, rates, taxes and other assessments, insurance premiums and charges and property management expenses are met by the tenant.

- Tenant required to redecorate/refurbish the centre once every 5 years as directed by CQE (acting reasonably).

- Typical lease term from commencement; 15 years plus two 5 year options.

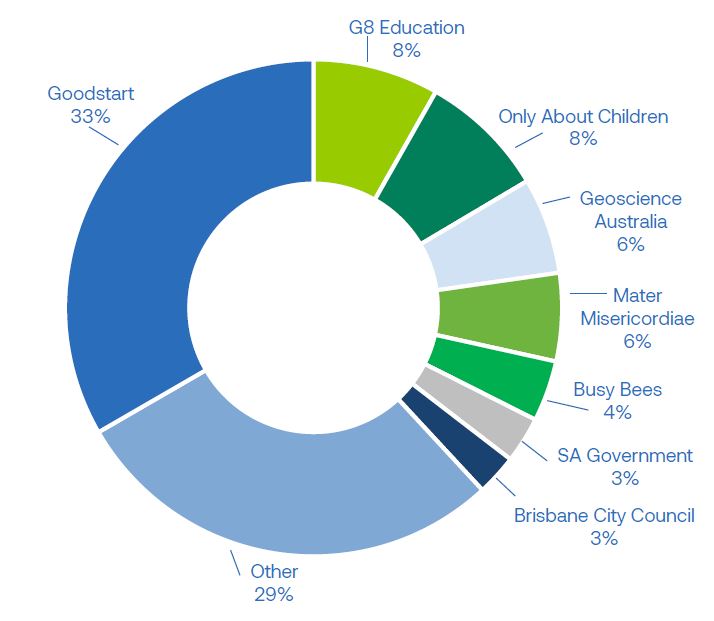

Tenant profile by % of annual rent as at 31 December 2023