David Clarke

Chair and Independent Non-Executive Director

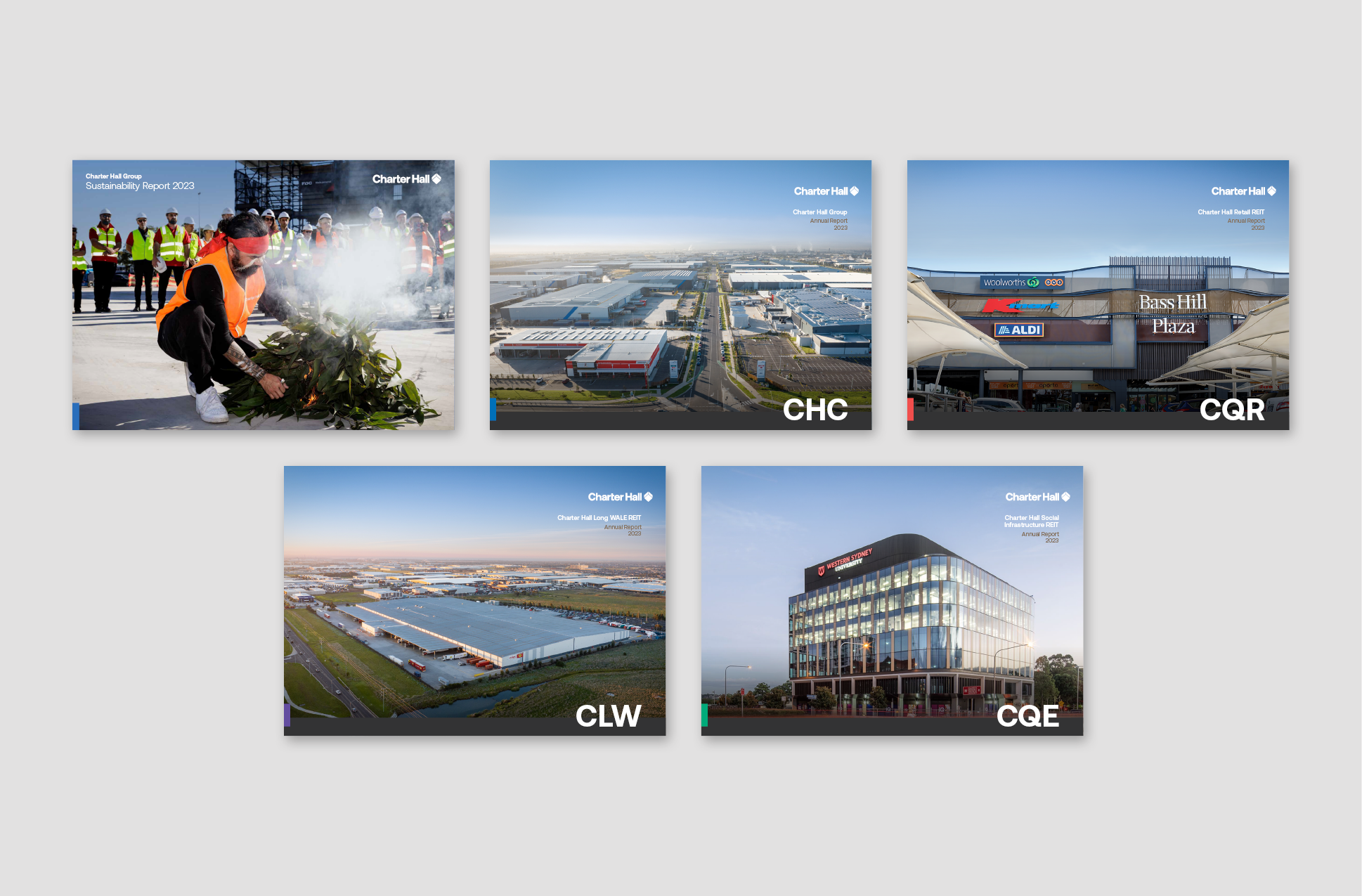

The Group has offices in Sydney, Melbourne, Brisbane, Adelaide and Perth and oversees a portfolio of 1,641 properties with over 11 million sqm of space leased.

We use our property expertise to access, deploy, manage and invest equity in our core real estate sectors to create value and generate superior returns for our customers.

View Charter Hall's corporate governance principles containing arrangements in place for the Group.

As a business focused on the future, sustainability is crucial. Find out about our sustainability commitments.

Building on our strong track record to achieve returns that are mutually beneficial.

Chair and Independent Non-Executive Director

Independent Non-Executive Director

Independent Non-Executive Director

Managing Director & Group CEO

Independent Non-Executive Director

.tmb-small.jpg?Culture=en&sfvrsn=1fd64073_1)

Independent Non-Executive Director

Independent Non-Executive Director

Head of Listed Investor Relations

We offer a range of investment options to a diverse range of investors