Charter Hall Retail REIT - FY22 Earnings Guidance on Q1 FY22 trading update

By proceeding you confirm that you are a resident of Australia or New Zealand accessing this website from within Australia or New Zealand and you represent, warrant and agree that:

- you are not in the United States or a “U.S. person”, as defined in Regulation S under the U.S. Securities Act of 1933, as amended (“U.S. Person”), nor are you acting for the account or benefit of a U.S. Person;

- you will not make a copy of the documents on this website available to, or distribute a copy of such documents to, or for the account or benefit of, any U.S. Person or any person in any other place in which, or to any other person to whom, it would be unlawful to do so; and

- the state, territory or province and postcode provided by you below for your primary residence in Australia or New Zealand are true and accurate.

Unfortunately, legal restrictions prevent us from allowing you access to this website. If you have any questions, please contact us by e-mail by clicking on the link below.

Charter Hall Retail REIT (ASX:CQR) is pleased to provide FY22 earnings and distribution guidance and an update on first quarter FY22 trading conditions.

Q1 FY22 Trading Update

First quarter FY22 trading conditions have continued to demonstrate the resilience of the CQR portfolio with strong trading performance despite the impacts of mandated lockdowns and trading restrictions in New South Wales and Victoria. Supermarket sales have been strong, with 5.1% sales growth for the September quarter, 3.1% MAT sales growth over 12 months and 11.1% MAT sales growth over two years to September 2021.

At the height of the lockdowns during August, 428 or 10.8% of CQR’s specialty tenants by total monthly portfolio income were closed. With the relaxation of lockdown and trading restrictions in NSW on Monday 11th October, only seven of NSW specialty tenants did not re-open for trade due to vaccination status of staff and are all due to re-open imminently. Pleasingly since reopening traffic to centres across NSW is returning to pre COVID-19 levels and communities are observing COVID-19 safe plans.

In light of the announcement that trading restrictions for Metropolitan Melbourne will be progressively lifted between Friday 22 October and Friday 5 November, it is expected that the majority of specialty tenants in the two impacted CQR centres will be open and trading by 5 November. It is expected that similar to previous lockdowns, trading conditions will rebound swiftly with a strong return to foot traffic, visitations and sales.

Portfolio occupancy has remained stable at 98.3%. Specialty leasing has temporarily been affected by lockdowns with new lease activity slowing during the quarter. Pleasingly, renewal activity has continued to be positive, with many tenants opting to take lease extensions during COVID-19 lease support negotiations. Charter Hall’s in-house retail leasing team has been focused on prioritising lease support to affected tenants and rental collection across the portfolio.

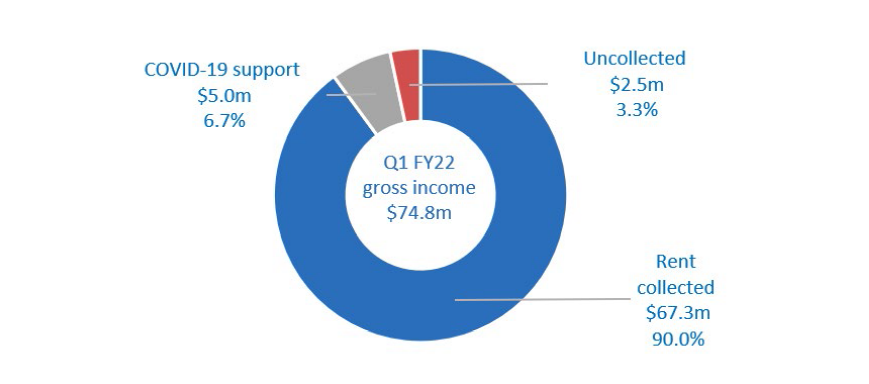

Collections for the period have continued to be strong, reflecting the resilience and defensive characteristics of the CQR portfolio. $67.3 million, or 90% of rent billed for the period has been collected, with $5.0 million or 6.7% rent provided as tenant support and $2.5 million or 3.3% of rent remaining for collection.

Rent collection and Tenant Support Summary (Ex GST)

FY22 Earnings Guidance

In light of lockdown restrictions being lifted recently in New South Wales and scheduled to be lifted in metropolitan Melbourne by early November, CQR is pleased to provide the following earnings guidance.

Barring any further unforeseen events, FY22 earnings per unit (EPU) is expected to be between 27.8 and 28.2 cents per unit (cpu) representing growth of 1.8% - 3.3% on FY21 earnings per unit.

Distributions per unit (DPU) are expected to be between 23.9 and 24.3 cpu representing growth of 2.1% - 3.8% on FY21 distributions per unit.

It is expected that the 2H FY22 distribution will be greater than the 1H FY22 distribution, reflecting the timing impacts of COVID-19 tenant support.

.tmb-news.jpg?Culture=en&sfvrsn=410360ec_1)

.tmb-news.jpg?Culture=en&sfvrsn=2e7e2809_1)

c04cf533418b45a2a0142e5da4e32aff.tmb-news.jpg?Culture=en&sfvrsn=6ed9caa5_1)