Unit Registry

Enquiries

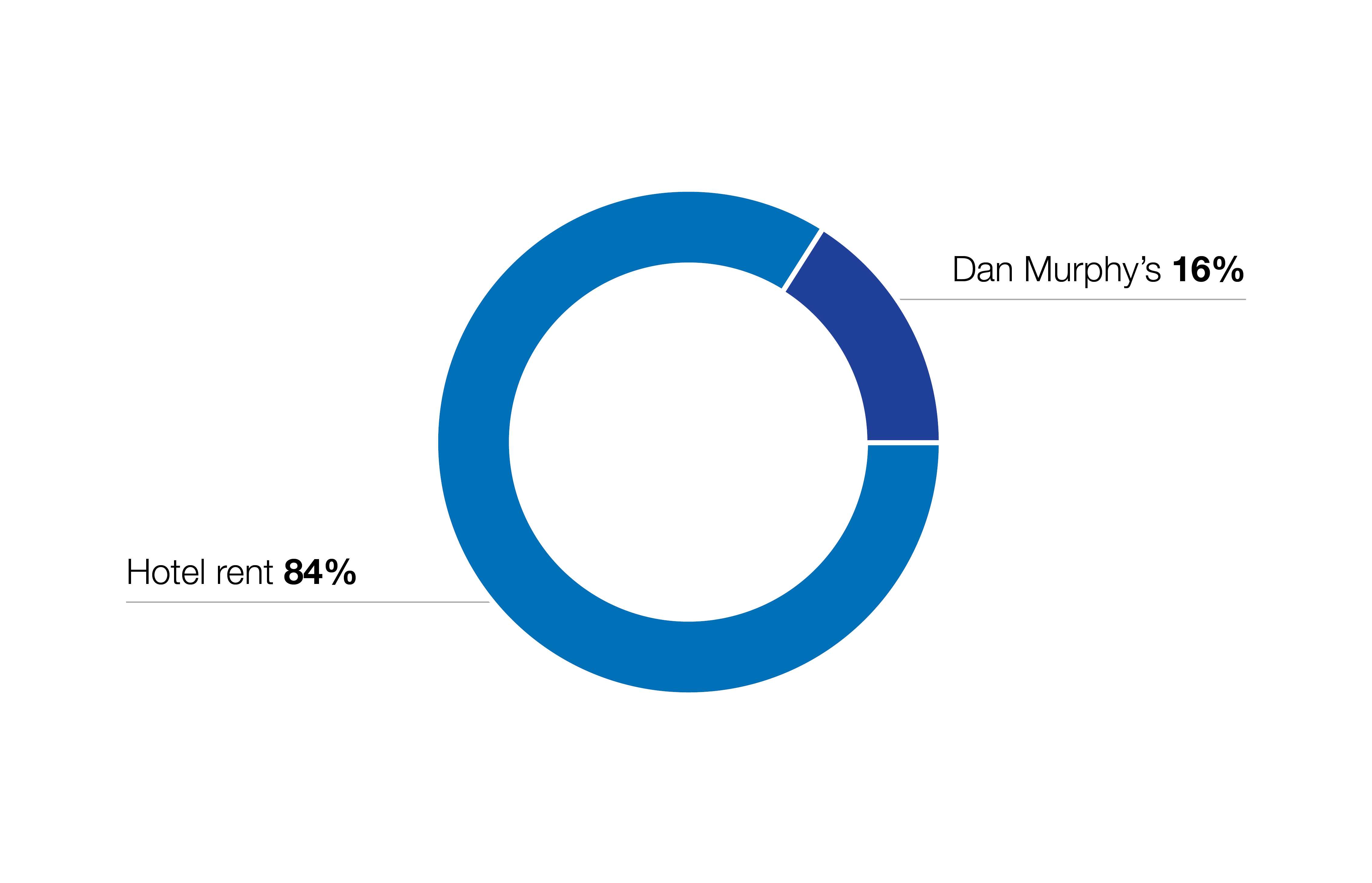

The LWIP Portfolio includes an interest in 60 retail assets. All retail assets are leased to ALH Group on triple net lease structures with all maintenance capital expenditure paid by the tenant. Rent under the ALH Group leases is increased annually by reference to CPI. The ALH Group leases include a Dan Murphy's rent for 21 of the 60 properties in the retail Portfolio. The Dan Murphy's rent is comprised of base rent and turnover rent.

All retail assets in the LWIP Portfolio are leased to ALH Group on triple net lease structures with all maintenance capital expenditure paid by the tenant.

Rent under the ALH Group leases is increased annually by reference to CPI. The ALH Group leases include a Dan Murphy's rent for 21 of the 60 properties in the retail Portfolio. The Dan Murphy's rent is comprised of base rent and turnover rent.

Income Diversity 1

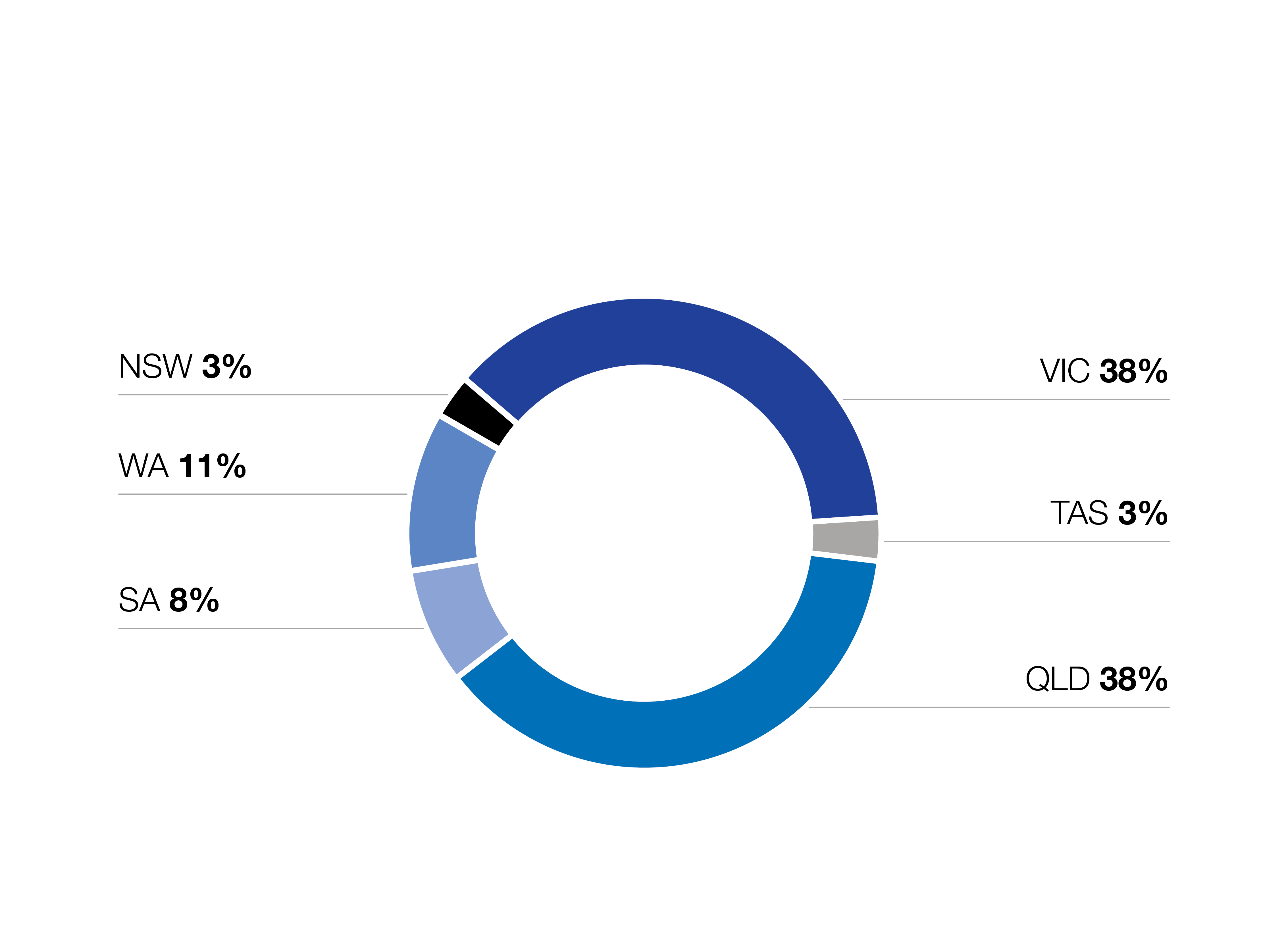

Geographic Diversity 2

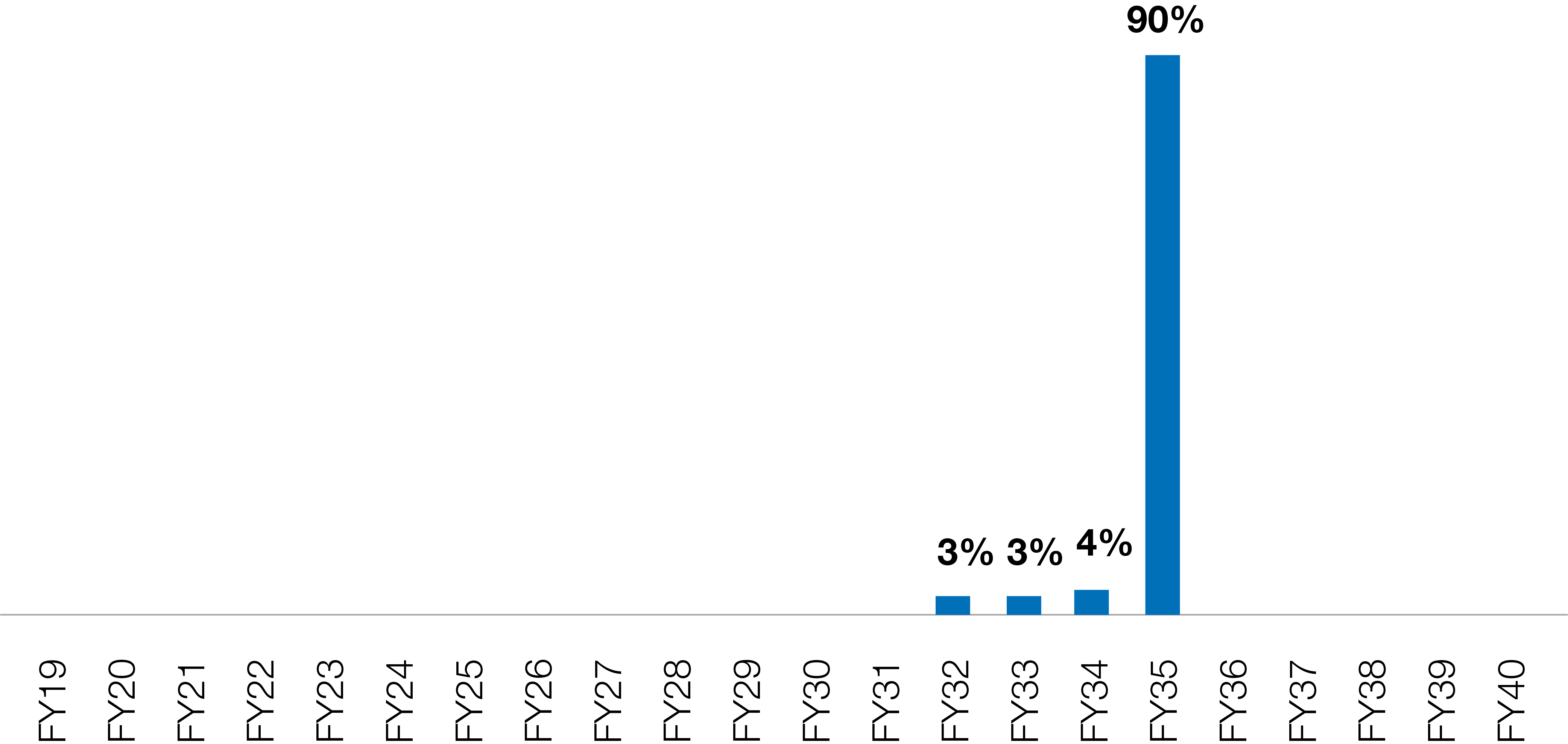

Lease Expiry Profile 1

Property | State | Suburb |

Excelisor Hotel | VIC | Thomastown |

Manhattan Hotel | VIC | Ringwood |

Waltzing Matilda Hotel | VIC | Sprigvale |

First & Last Hotel | VIC | Hadfield |

Moreland Hotel | VIC | Brunswick |

St Albans Hotel | VIC | St Albans |

Cherry Hill Tavern | VIC | Doncaster |

Glengala Hotel | VIC | Sunshine |

Balaclava Hotel | VIC | St Kilda East |

Albion Charles Hotels | VIC | Northcote |

Croxton Park Hotel | VIC | Thornbury |

Oakleigh Junction Hotel | VIC | Oakleigh |

Palace Hotel | VIC | Camberwell |

Monash Hotel | VIC | Clayton |

Coolaroo Hotel | VIC | Coolaro |

Bridge Inn Hotel | VIC | Mernda |

Harvey Road Tavern | VIC | Gladstone |

Kawana Waters Hotel | QLD | Kawana Waters |

Villa Noosa Hotel | QLD | Noosaville |

Hinterland Hotel Motel | QLD | Nerang |

Federal Hotel | QLD | Toowoomba |

Glenmore Tavern | QLD | Rockhampton |

Buderim Tavern | QLD | Buderim |

Redbank Plains Tavern | QLD | Redbank Plains |

Dog and Parrot Hotel | QLD | Robina |

Allenstown Hotel | QLD | Rockhampton |

Parkwood Tavern | QLD | Parkwood |

Royal Beenleigh Hotel | QLD | Beenleigh |

|

Property |

State |

Suburb |

|

Capalaba Tavern |

QLD |

Capalaba |

|

Highfields Tavern |

QLD |

Highfields |

|

Russell Tavern |

QLD |

Dalby |

|

Waterfront Hotel |

QLD |

Diddilabah |

|

Brunswick Hotel |

QLD |

New Farm |

|

Old Sydney Hotel |

QLD |

Maryborough |

|

Commercial Hotel |

WA |

Nerang |

|

Greenwood Hotel |

WA |

Greenwood |

|

Hyde Park Hotel |

WA |

West Perth |

|

Belmont Tavern |

WA |

Cloverdale |

|

Lakers Tavern |

WA |

Bunbury |

|

Dunsborough Hotel |

WA |

Thornlie |

|

Peel Alehouse |

WA |

Dunsborough |

|

Bull Creek Tavern |

WA |

Halls Head |

|

Herdsman Lake Tavern |

WA |

Bull Creek |

|

Ship Inn |

WA |

Wembley |

|

Findon Hotel |

SA |

Busselton |

|

Slug n Lettuce Pub |

SA |

Findon |

|

Norwood Hotel |

SA |

Parafield Gardens |

|

Victoria Hotel |

SA |

Norwood |

|

Royal Oak |

SA |

O'Halloran Hill |

|

Federal Hotel |

SA |

North Adelaide |

|

Westower Tavern |

NSW |

Mt Gambier |

|

Greenhouse Tavern |

NSW |

West Ballina |

|

Boomerang Hotel |

NSW |

Coffs Harbour |

|

Gateway Inn Hotel |

TAS |

Lavington |

|

Carlyle Hotel |

TAS |

Devonport |

|

Riverside Hotel Motel |

TAS |

Derwent Park |

Enquiries