Ampol Portfolio

Portfolio Overview

The Charter Hall managed partnership (GIC 95%, CQR 5%) owns a 49% interest in a portfolio of 204 long WALE convenience retail properties leased to AMPOL across Australia. The properties are an important part of the AMPOL fuel and convenience retail network in Australia and feature attractive triple net lease structures, with AMPOL responsible for all outgoings, repairs, maintenance and capital expenditure. The portfolio is geographically diverse and features CPI linked rental increases with minimum 2% and maximum 5% increases per annum.

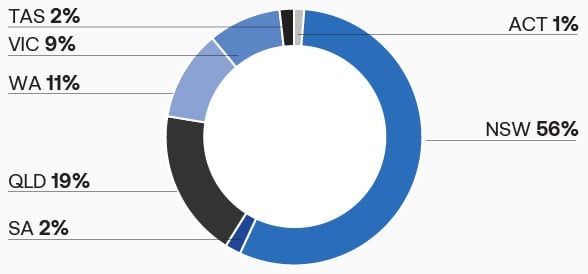

Geographic Diversity

Geographic Diversity 1

1 Weighted by external valuation

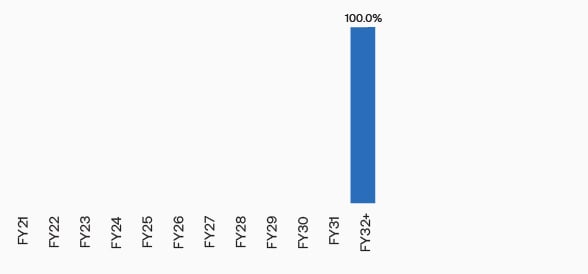

Lease Expiry Profile

Lease Expiry Profile 2

2 Weighted by net passing income

Important Information

Talk to us

Thanks for your interest in Charter Hall. Fill in your details below and we’ll get back to you as soon as possible.

I am interested in

Enquiry

*Indicates that this field is required.

All personal information submitted will be treated in accordance with our privacy policy.

By registering and/or submitting personal data to Charter Hall, you agree that, where it is permitted by law and in accordance with our Privacy Statement or where you have agreed to receive communications from us, Charter Hall may use this information to notify you of our products and services and seek your feedback on our products and services. Please note you can manually opt out of any communications.

-

© Charter Hall Group, 2024.

- Terms of Use

- Privacy Policy

- Complaints Guide

- Feedback